Parametric Sound Provides Post Merger Update

Introduces 2014 Outlook for the Combined Company

SAN DIEGO, CA, March 27, 2014 – Parametric Sound Corporation (NASDAQ: PAMT) today filed an amendment to its Current Report on Form 8-K originally filed on January 16, 2014 which includes audited financial statements for Turtle Beach (VTB Holdings, Inc. and its subsidiaries) along with unaudited pro forma financial information of the combined companies as of and for the year ended December 31, 2013.

Business Update

- Merger between Parametric Sound and Turtle Beach successfully closed January 15, 2014 and the teams are now fully integrated.

- Corporate name change to Turtle Beach Corporation and ticker symbol change to HEAR is underway and expected to be complete by May. The new name will not affect our business, operations, reporting requirements or stock price but will require a new CUSIP.

- First-to-market with three Xbox One compatible headsets at retail on March 6, including a licensed model for the highly anticipated game Titanfall released on March 11.

- Sony PlayStation® 4 and Microsoft Xbox® One consoles continue to report strong sales, providing a rapidly growing installed base of new generation platforms, which we estimate to be over 10 million units already.

- Sales for the first quarter of 2014 are trending positively and expected to increase approximately 10% over the same period in 2013, which was a strong quarter, and more than 50% over the same period in 2012.

- Received U.S. Food and Drug Administration (FDA) clearance for the marketing of a product incorporating the HyperSound® Audio System as a hearing improvement device.

- HyperSound sales team in place and driving revenue growth in multiple commercial segments. Development of first product for hearing impaired listeners underway for anticipated 2015 launch. R&D staffing expanded and pursuing further HyperSound technology advancements.

- Work continues and is progressing well on improving the company’s credit facility to provide a global line more suited to the company’s needs and growth plans.

“We are very excited about the strong prospects we believe exist for our Turtle Beach and HyperSound businesses,” said Juergen Stark, chief executive officer of Parametric Sound. “The recent merger has created a company with significant growth opportunities in consumer, commercial and healthcare audio. Our plan is to leverage our proprietary audio technology and operational strengths to continue to bring to market innovative, high quality audio products that elevate the consumer experience and drive sustainable growth and increased shareholder value.”

2013 Turtle Beach (VTB Holdings, Inc.) Review

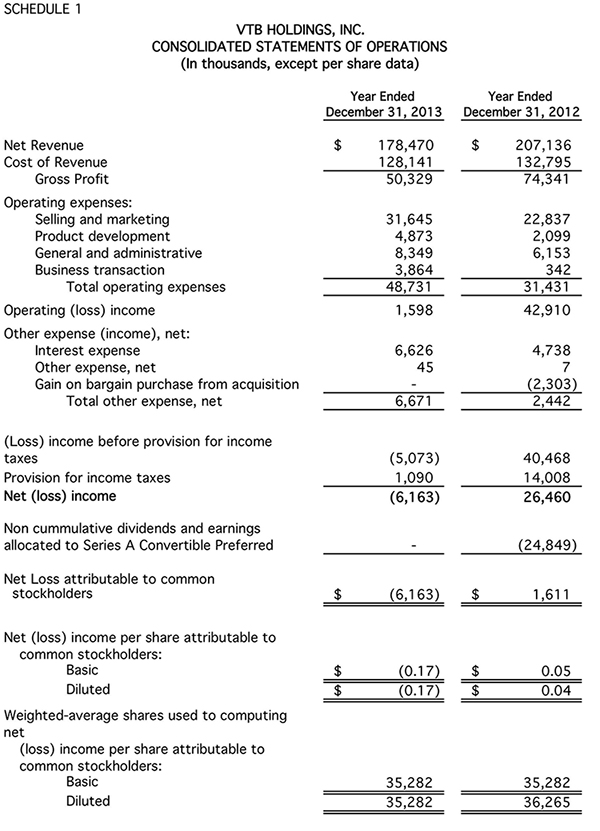

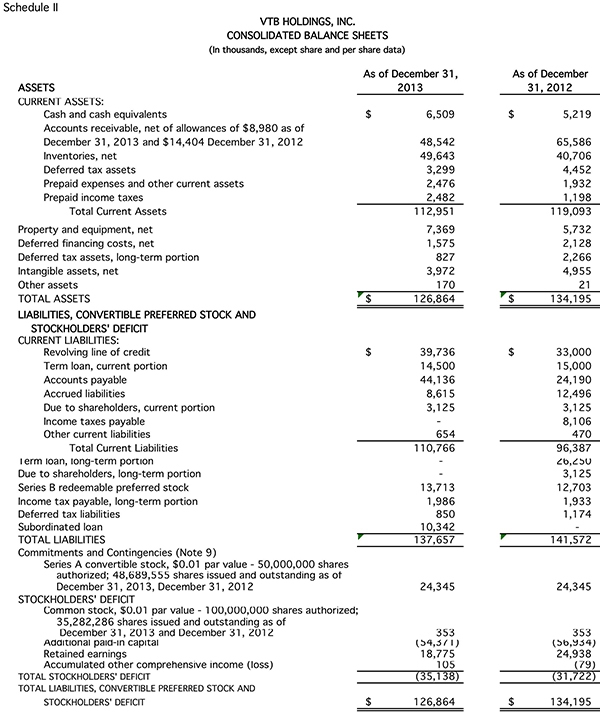

The audited consolidated financial statements of Turtle Beach for years ended December 31, 2013 and prior relate to a pre-Closing period, and therefore all information presented herein, including any per share information, relates to Turtle Beach on a standalone basis and not Parametric Sound or the combined company. The first combined results will be reported for the first quarter ending March 31, 2014.

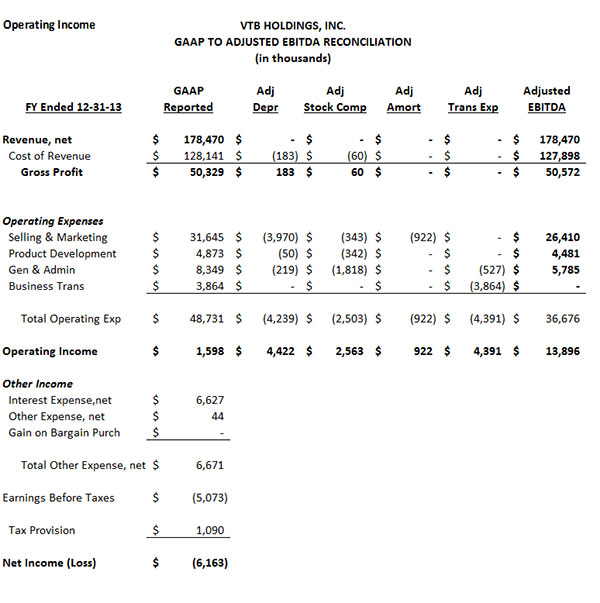

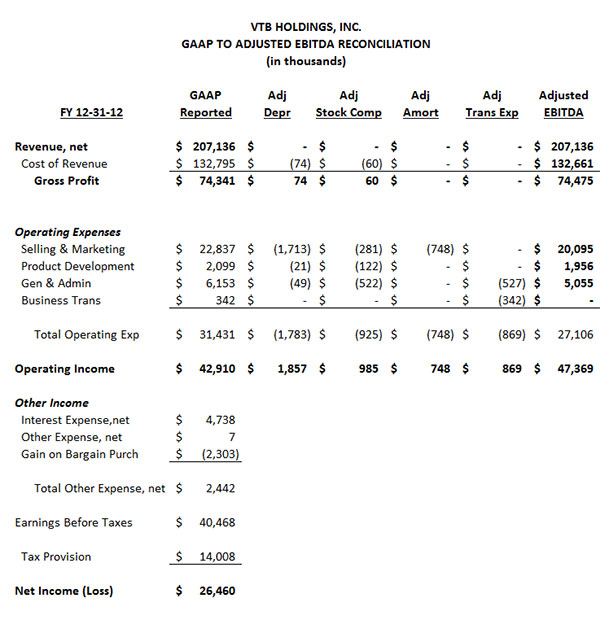

2013 net revenue was $178.5 million, compared with $207.1 million in 2012. As expected, transitions of both the Microsoft Xbox and Sony PlayStation consoles in 2013 contributed to a down year for the gaming industry. Microsoft’s delayed implementation of headset audio for the Xbox One console until March 2014 also meaningfully reduced our Q4 revenues. 2013 Adjusted EBITDA (as defined below) was $13.9 million, compared with $47.4 million in the year ago period. See the accompanying tables at the end of this release for a reconciliation of Adjusted EBITDA.

“The gaming industry experienced a cyclical event last year as Microsoft and Sony each introduced new consoles for the first time in eight years,” commented Stark. “The temporary headwinds we experienced throughout most of last year, as consumers delayed purchases in advance of the introduction of new consoles, have begun to ease. The consumer response to Xbox One and PlayStation 4 has been overwhelmingly positive creating a rapidly growing installed base, which we estimate to be over 10 million units already. As the leader in gaming headsets we are well positioned to benefit from the anticipated growth in the segment as consumers purchase new consoles over the next three years and beyond.”

Outlook

For 2014, the company currently forecasts net revenues in the Turtle Beach headset segment to be in the range of $210 to $230 million representing growth of approximately 24% over 2013 levels at the mid-point of the range. The strong anticipated revenue growth is primarily driven by the expected rebound in the core console gaming headset market, which we expect to be a multi-year trend. Net revenues from HyperSound are expected to be in the range of $1 to $4 million consistent with our expectations for the early stages of commercializing that technology. Gross margins are expected to be approximately 30%, a 150 basis point increase over 2013 with further improvement expected in 2015 as Turtle Beach’s gaming headset product portfolio for new consoles expands and HyperSound becomes a more material part of the revenues.

Full Year Adjusted EBITDA for the Turtle Beach headset segment is expected to be in the range of $30 to $35 million representing growth of over 100% from 2013 and an Adjusted EBITDA margin of approximately 15% at the mid-point of the range, up from approximately 8% in 2013 (approximately a 700 basis point improvement). The company plans to invest approximately $10 million dollars in HyperSound in 2014 in order to capitalize on the broad array of expected future opportunities for this technology. Total company Adjusted EBITDA for 2014 therefore is expected to be in the range of $20 to $25 million, representing anticipated growth of approximately 140% over the pro-forma combined company Adjusted EBITDA for 2013 at the mid-point of the range. The combined Adjusted EBITDA range for 2014 also reflects approximately $3 million of additional public company associated general and administrative costs. As of the completion of the merger, the combined company had approximately 37 million shares outstanding.

Stark concluded, “We believe 2014 represents the initial stage of the post console transition rebound for the gaming industry and Turtle Beach. The recent launch of our Xbox One compatible headset is another step towards returning our business to a more normalized run rate. In addition, we continue to be very excited about the market opportunities from our HyperSound technology. We expect our top-line momentum to accelerate in 2015 driven by the introduction of a full line of Turtle Beach headsets for new generational consoles including more mid-tier and high-end styles, and fully wireless options. At the same time, we expect that the commercialization of HyperSound will begin contributing much more meaningfully to our financial results in 2015 as we continue to grow the commercial business for HyperSound and introduce the first HyperSound product for people with hearing impairments.”

Conference Call Details

Juergen Stark, CEO, and John Hanson, CFO, will host a conference call and simultaneous webcast to discuss the financial results and outlook today, March 27, 2014, at 1:30 PM Pacific Time / 4:30 PM Eastern Time. To participate in the conference call, investors should dial (877) 303-9855 (domestic) or (408) 337-0154 (international) 10 minutes prior to the scheduled start of the call. A simultaneous audio-only webcast of the call may be accessed on the Internet at http://www.parametric sound.com. An archive of the webcast will be available on the company’s website through June 30, 2014, and a recorded replay of the call will be available one week at (855) 859-2056 or (404) 537-3406 and entering conference ID number 17105196.

Non-GAAP Financial Measures

In addition to its reported results, Parametric Sound has included in this earnings release certain financial results that the Securities and Exchange Commission defines as “non-GAAP financial measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. These non-GAAP financial measures relate to presenting Adjusted EBITDA, as defined by the Company, for the years ended December 31, 2013, and 2012. Please see a reconciliation of GAAP results to Adjusted EBITDA which is included below for the years ended December 31, 2013, and 2012.

All trademarks are the property of their respective owners.

Forward-Looking Statements

This press release includes forward-looking information and statements within the meaning of the federal securities laws. Except for historical information contained in this release, statements in this release may constitute forward-looking statements regarding assumptions, projections, expectations, targets, intentions or beliefs about future events. Forward looking statements are based on management’s statements containing the words “may”, “could”, “would”, “should”, “believe”, “expect”, “anticipate”, “plan”, “estimate”, “target”, “project”, “intend” and similar expressions constitute forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Forward-looking statements are based on management’s current belief, as well as assumptions made by, and information currently available to, management.

While the Company believes that its expectations are based upon reasonable assumptions, there can be no assurances that its goals and strategy will be realized. Numerous factors, including risks and uncertainties, may affect actual results and may cause results to differ materially from those expressed in forward-looking statements made by the Company or on its behalf. Some of these factors include, but are not limited to, the substantial uncertainties inherent in acceptance of existing and future products, the difficulty of commercializing and protecting new technology, the impact of competitive products and pricing, general business and economic conditions, risks associated with the expansion of our business including the implementation of any businesses we acquire, our indebtedness, and other factors discussed in our public filings, including the risk factors included in the Company’s Annual Report on Form 10-K and other periodic reports filed with the SEC, as well as the Company’s Proxy Statement on Schedule 14A filed in connection with our merger with Turtle Beach Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission the Company any is under no obligation to publicly update or revise any forward-looking statement after the date of this release whether as a result of new information, future developments or otherwise.