– Fourth Quarter Sees Record Profitability Since Becoming Public in 2014 –

San Diego, CA – March 6, 2018 – Turtle Beach Corporation (NASDAQ: HEAR), a leading gaming headset and audio accessory company, reported financial results for the fourth quarter and full year ended December 31, 2017.

Fourth Quarter Summary vs. Year-Ago Quarter:

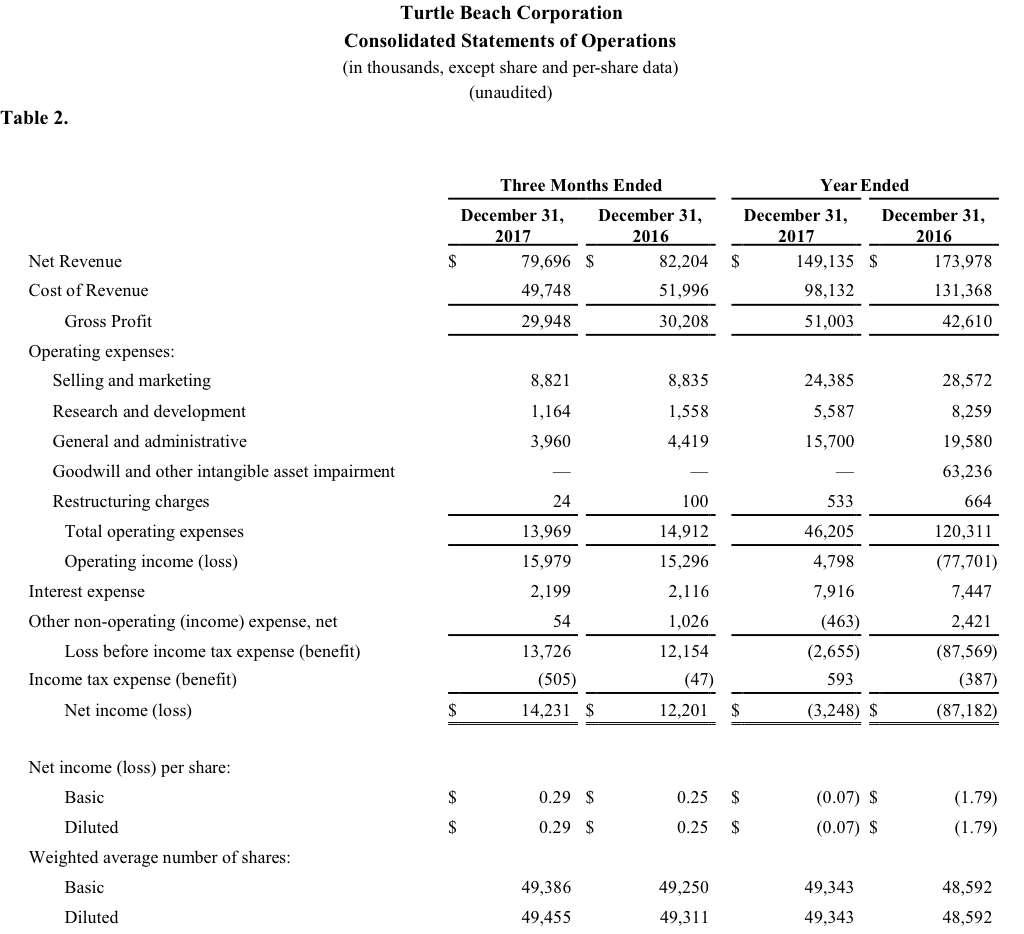

· Net revenue of $79.7 million versus $82.2 million, down slightly due to channel inventory reductions.

· Gross margin up 90 basis points to a record 37.6%.

· Operating expenses were reduced by 6% to $14.0 million.

· Net income up 17% to a record $14.2 million, or $0.29 per share, compared to $12.2 million, or $0.25 per share.

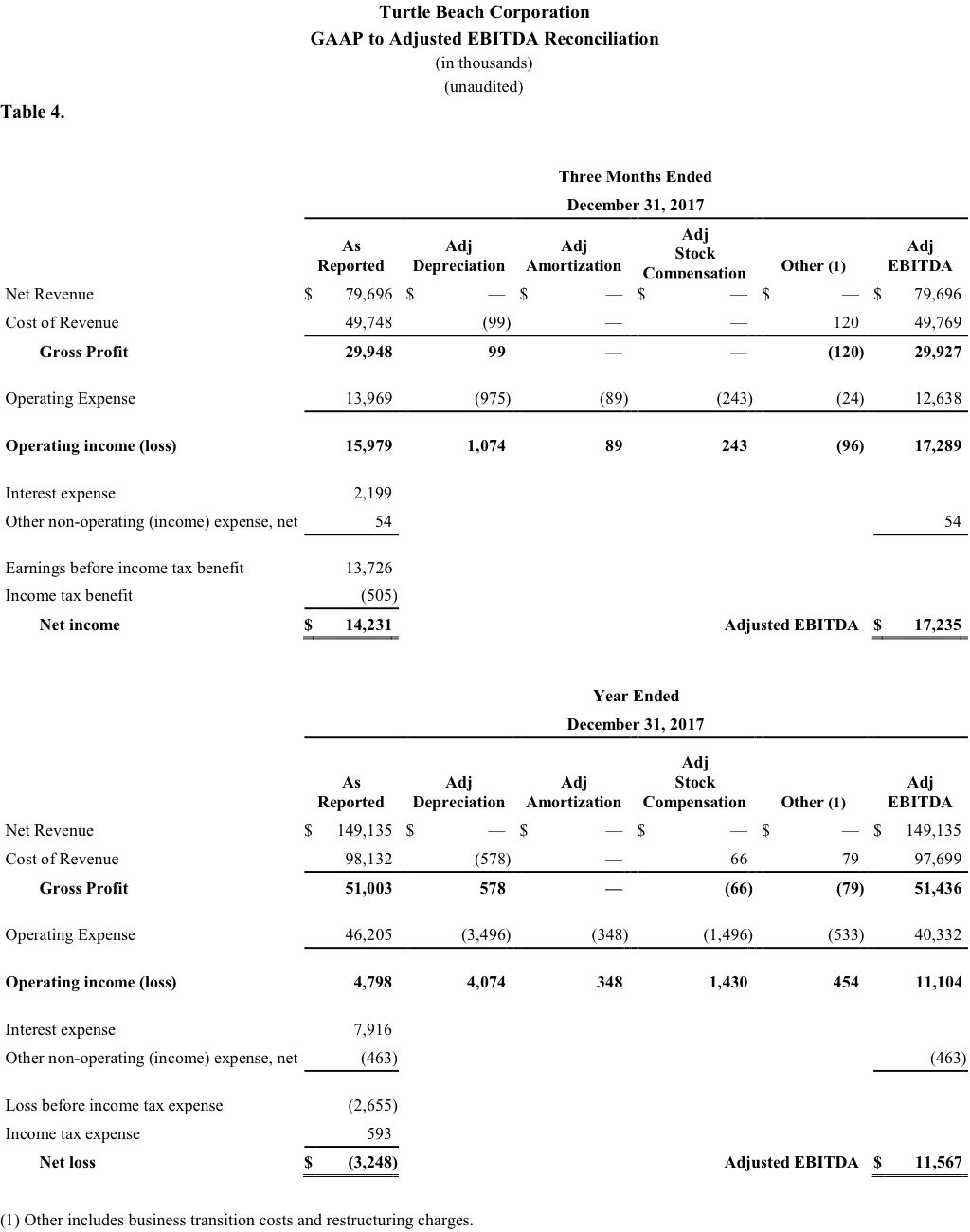

· Adjusted EBITDA up 7% to a record $17.2 million.

· Leverage ratio declined to 2.1x versus 7.4x.

2017 Summary vs. 2016:

· Net revenue of $149.1 million versus $174.0 million, down due to channel inventory reductions and under-ordering by several retailers.

· Gross margin up 970 basis points to a record 34.2%.

· Operating expenses were reduced 18% to $46.2 million from $56.4 million (excluding $63.9 million in HyperSound impairment and restructuring charges in 2016).

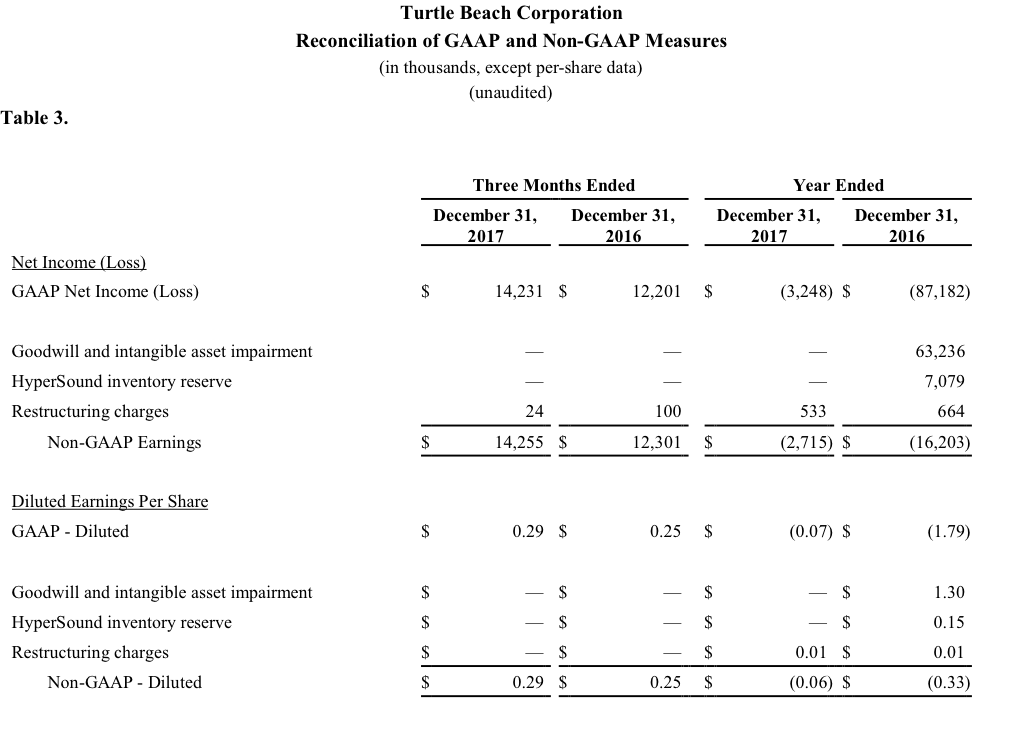

· Net loss improved significantly to $3.2 million, or $(0.07) per share, compared to a net loss of $87.2 million, or $(1.79) per share.

· Nearly tripled adjusted EBITDA, reporting $11.6 million versus $4.0 million.

“As reported in February, we experienced strong sales of Turtle Beach headsets in the fourth quarter, which helped drive our leading market share higher,” said Juergen Stark, CEO, Turtle Beach. “Healthy consumer demand and retailer restocking early in the first quarter of 2018 has more than closed a $6-7 million sales shortfall compared to our 2017 outlook, caused by cautious retail ordering in the fourth quarter.”

“In fact, NPD data shows we are outpacing a very strong market in the first quarter, with North American console gaming headset sell-through in January up 61% on a revenue basis and Turtle Beach up 79%. We believe this is being driven by the blockbuster Fortnite and PlayerUnknown’s Battlegrounds releases that are fueling strong headset sales, as well as an overall robust gaming market.”

“Underlying our strong sales performance were market share gains in both North America and the U.K., which we believe show Turtle Beach continues to be the undisputed market leader in gaming headsets—a position we have held for eight years in a row. As we look to 2018, we intend to leverage this leadership position by continuing to develop our growing eSports presence and laying the groundwork for future growth in the $1.1 billion gaming peripherals market.”

“Looking to 2018, having met our goal of significantly increasing adjusted EBITDA and earnings in 2017, we believe Turtle Beach is well-positioned to make selective investments to drive future growth. Given today’s announcement regarding the improvements to our financing agreements, we are also expecting to lower our debt-related expenses and increase our financial flexibility.”

Fourth Quarter 2017 Financial Results

Net revenue in the fourth quarter of 2017 was $79.7 million compared to $82.2 million in the year-ago quarter. The decline was largely due to under-ordering by several retailers in December, which was more than covered by restocking orders in January 2018.

Gross margin in the fourth quarter of 2017 increased by 90 basis points to a record 37.6% compared to 36.7% in the 2016 period. This is the Company’s highest level of gross margin for any fourth quarter since becoming public in 2014. The increase was due to a mix-shift toward higher margin headsets, as well as on-going supply chain and logistics-driven product cost improvements.

Operating expenses in the fourth quarter of 2017 were reduced by 6% to $14.0 million compared to $14.9 million in the 2016 period due to a continued focus on cost management across the business.

Net income in the fourth quarter of 2017 increased 17% to a record $14.2 million, or $0.29 per diluted share, compared to $12.2 million, or $0.25 per diluted share, in the 2016 period. This is the Company’s highest level of net income for any quarter since becoming public in 2014. The improvement was primarily driven by the higher gross margin and lower operating expenses.

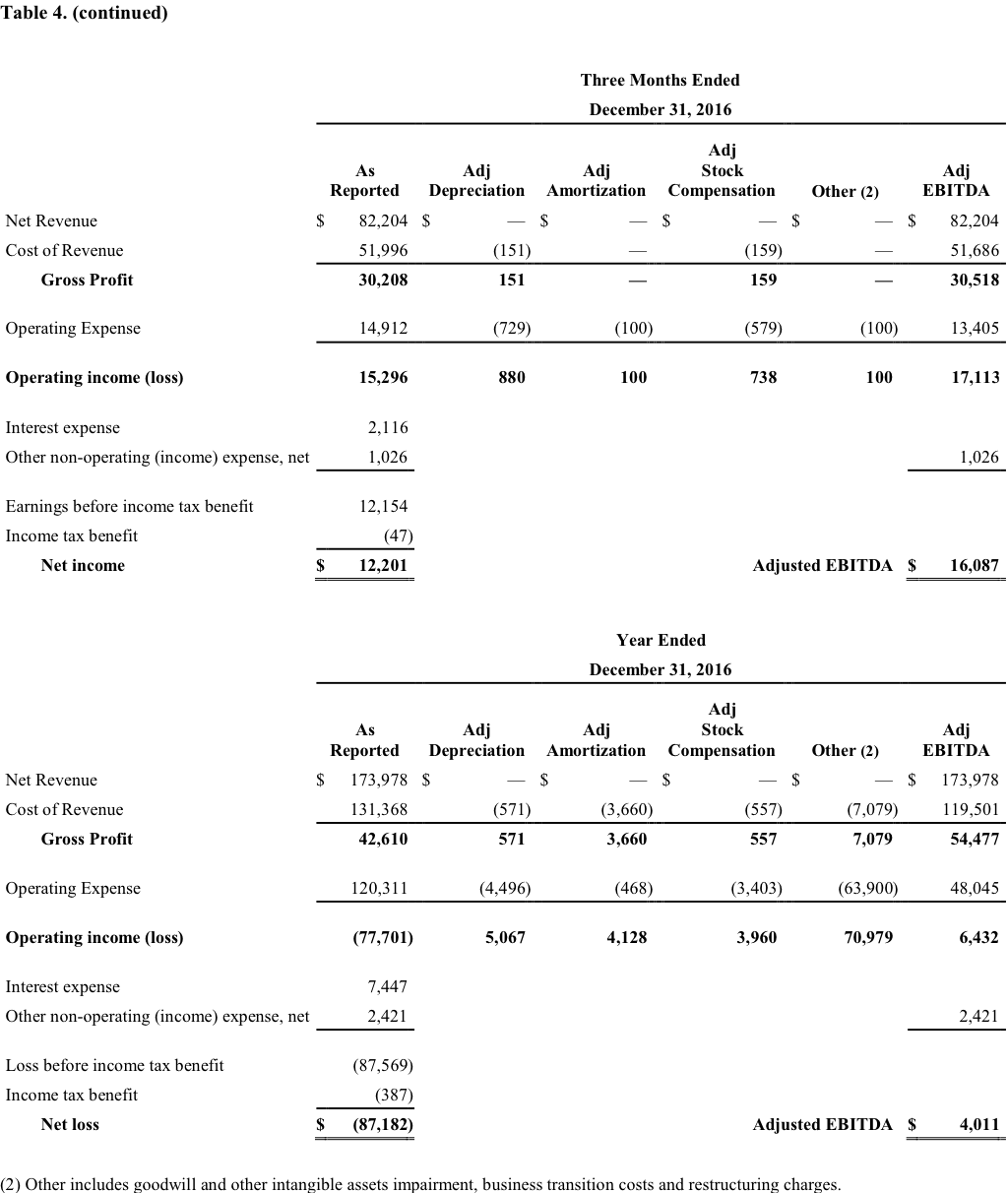

Adjusted EBITDA (as defined below in “Non-GAAP Financial Measures”) in the fourth quarter of 2017 increased 7% to $17.2 million compared to $16.1 million in the year-ago quarter. This is the Company’s highest level of quarterly adjusted EBITDA since becoming public in 2014.

Full Year 2017 Financial Results

Net revenue in 2017 was $149.1 million compared to $174.0 million in 2016. A significant portion of the revenue decline was driven by channel inventory reductions in 2017 and under-ordering by several retailers this past December that was more than covered by restocking orders in January 2018.

Gross margin in 2017 improved 970 basis points to 34.2% from 24.5% in 2016. This is the Company’s highest level of annual gross margin since becoming public in 2014. The increase was due to the higher margin headset mix-shift and supply chain and logistics-driven product cost improvements, as well as the transition of HyperSound to a license model.

Operating expenses in 2017 declined significantly to $46.2 million compared to $120.3 million in 2016. The decline was primarily driven by HyperSound impairment charges in 2016 of $63.2 million that did not reoccur, as well as continued cost management across the business. Excluding HyperSound-related impairment and restructuring charges, operating expenses in 2016 were $56.4 million.

Net loss in 2017 improved significantly to $3.2 million, or $(0.07) per diluted share, compared to a net loss of $87.2 million, or $(1.79) per diluted share in 2016, which included the HyperSound-related impairment and restructuring charges.

Adjusted EBITDA (as defined below in “Non-GAAP Financial Measures”) was up significantly in 2017 to $11.6 million compared to $4.0 million in 2016. This is the highest level of adjusted EBITDA the company has reported since becoming public in 2014.

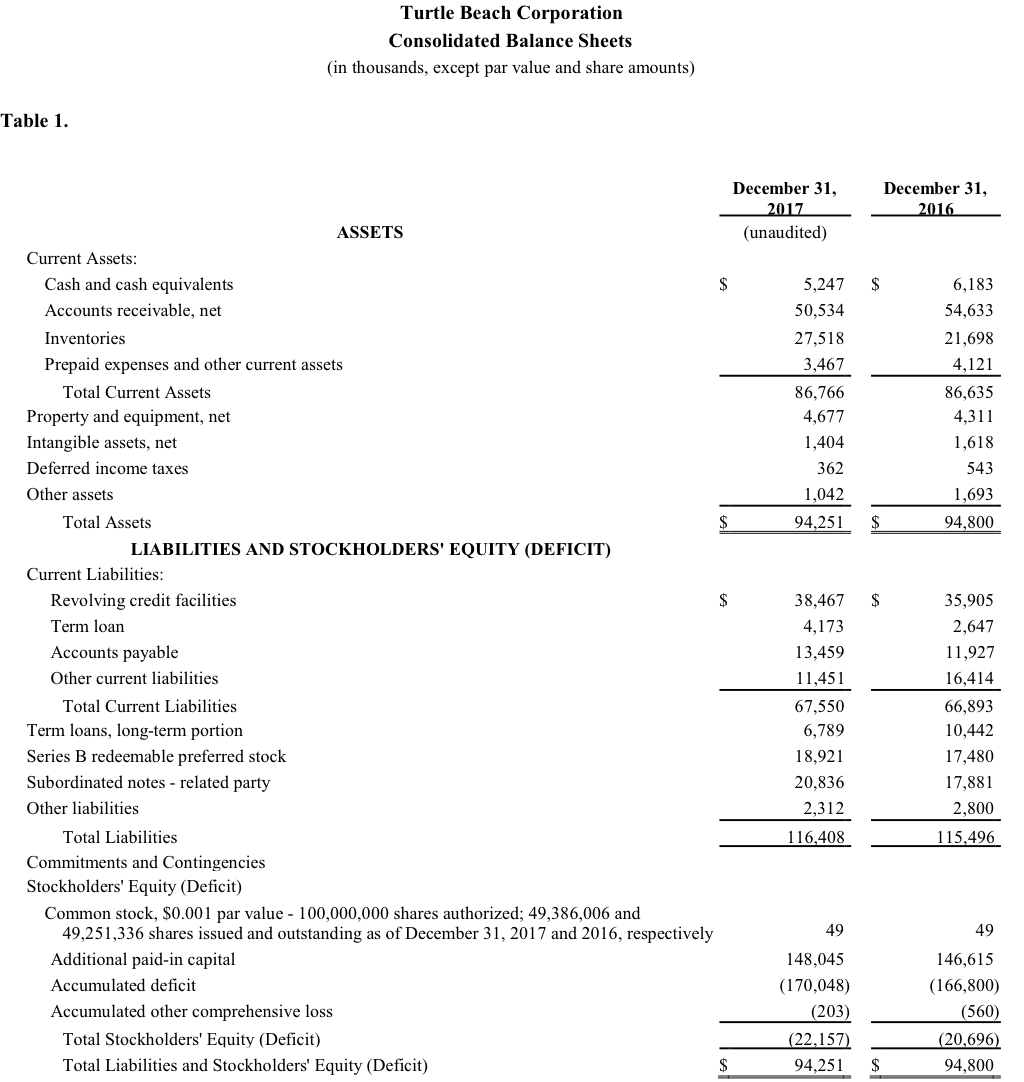

Balance Sheet Highlights

At December 31, 2017, the Company had approximately $5.2 million of cash and cash equivalents, compared to $6.2 million one year ago. As a result of its borrowings under a $60 million revolving credit facility, Turtle Beach generally does not hold a large cash balance.

Total outstanding debt principal at December 31, 2017, was $72.1 million compared to $69.7 million at December 31, 2016. The debt consisted of $38.5 million of revolving debt, $21.9 million in subordinated debt, and $11.7 million in term loans. The Company’s leverage ratio, defined as total term loans outstanding and average trailing twelve month revolving debt, divided by consolidated trailing twelve month adjusted EBITDA, improved significantly to 2.1x at December 31, 2017, compared to 7.4x one year ago.

As announced in a separate press release today, Turtle Beach has amended its financing agreements with its lenders. The improved terms and covenants include a reduction in the interest rate of the revolving credit facility and term loans, a reduction in the interest rate on the subordinated debt, the ability to use term loan funds to reduce the subordinated debt, the elimination of EBITDA coverage covenants on the term loans, and the extension of the loans to March 2023. The net effect of the changes is expected to be interest savings of at least $3.5 million over the next five years.

2018 Outlook

For the first quarter of 2018, Turtle Beach expects net revenue to increase 102% to approximately $29 million compared to $14.4 million in the first quarter of 2017. Net loss for the first quarter of 2018 is expected to improve to approximately $0.12 per share compared to a loss of $0.20 per share in the 2017 period. Adjusted EBITDA in the first quarter of 2018 is expected to improve to approximately $(1.5) million compared to $(6.2) million in the 2017 period.

For the full year 2018, Turtle Beach expects net revenue to increase 5% to approximately $157 million compared to $149.1 million in 2017. This mid-single-digit increase assumes the mix of quarterly revenues will be shifted earlier in the year (similar to 2016) and the slate of AAA console games to be released for holiday 2018 will not match the exceptionally strong retail sales seen in holiday 2017. Full details on the 2018 slate will be revealed throughout the year, including at the Electronic Entertainment Expo show in mid-June, and full-year industry expectations will be updated accordingly. Net loss in 2018 is expected to improve to approximately $0.03 per share based upon 49.4 million expected diluted shares outstanding. This is compared to a net loss of $0.07 per share in 2017. Adjusted EBITDA in 2018 is expected to improve to approximately $12 million and includes several million dollars of investments intendend to drive future growth.

A table summarizing this outlook has been provided at the end of this release.

With respect to the Company’s adjusted EBITDA outlook for the first quarter and full year 2018, a reconciliation to its net loss outlook for the same periods has not been provided because of the variability, complexity, and lack of visibility with respect to certain reconciling items between adjusted EBITDA and net loss, including other income (expense), provision for income taxes and stock-based compensation. These items cannot be reasonably and accurately predicted without the investment of undue time, cost and other resources and, accordingly, a reconciliation of the Company’s adjusted EBITDA outlook to its net loss outlook for such periods is not available without unreasonable effort. These reconciling items could be material to the Company’s actual results for such periods.

Conference Call Details

Turtle Beach Corporation will hold a conference call today, March 6, 2018, at 2:00 p.m. Pacific time (5:00 p.m. Eastern) to discuss its fourth quarter and full year 2017 results.

CEO Juergen Stark and CFO John Hanson will host the call, followed by a question and answer session.

Conference Call Details:

Date: Tuesday, March 6, 2018

Time: 5:00 p.m. ET / 2:00 p.m. PT

Toll-Free Dial-in Number: (877) 303-9855

International Dial-in Number: (408) 337-0154

Conference ID: 3799958

For the conference call, please dial-in 5-10 minutes prior to the start time and an operator will register your name and organization. If you have any difficulty with the conference call, please contact Liolios at (949) 574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website at corp.turtlebeach.com.

A replay of the conference call will be available after 8:00 p.m. ET on the same day through March 13, 2018.

Toll-Free Replay Number: (855) 859-2056

International Replay Number: (404) 537-3406

Replay ID: 3799958

Non-GAAP Financial Measures

In addition to its reported results, the Company has included in this earnings release certain financial results, including adjusted EBITDA, that the Securities and Exchange Commission defines as “non-GAAP financial measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s results. “Adjusted EBITDA” is defined by the Company as net income (loss) before interest, taxes, depreciation and amortization, stock- based compensation (non-cash), and certain special items that we believe are not representative of core operations. See a reconciliation of GAAP results to adjusted EBITDA included below for the three and twelve months ended December 31, 2017.

About Turtle Beach Corporation

Turtle Beach (www.turtlebeach.com) has been revolutionizing console multiplayer gaming since the very beginning with its wide selection of industry-leading, award-winning gaming headsets. Whether you’re a professional eSports athlete, hardcore gamer, casual player, or just starting out, Turtle Beach has the gaming headset to help you truly master your skills. Innovative and advanced technology, amazing audio quality, clear communication, lightweight and comfortable designs, and ease-of-use are just a few features that have made Turtle Beach a fan-favorite brand for gamers the world over. Made for Xbox and PlayStation® consoles as well as for PC, Mac®, and mobile/tablet devices, having a Turtle Beach gaming headset in your arsenal gives you the competitive advantage. The Company’s shares are traded on the NASDAQ Exchange under the symbol: HEAR.

Cautionary Note on Forward-Looking Statements

This press release includes forward-looking information and statements within the meaning of the federal securities laws. Except for historical information contained in this release, statements in this release may constitute forward-looking statements regarding assumptions, projections, expectations, targets, intentions, or beliefs about future events. Statements containing the words “may”, “could”, “would”, “should”, “believe”, “expect”, “anticipate”, “plan”, “estimate”, “target”, “project”, “intend” and similar expressions constitute forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Forward-looking statements are based on management’s current belief, as well as assumptions made by, and information currently available to, management.

While the Company believes that its expectations are based upon reasonable assumptions, there can be no assurances that its goals and strategy will be realized. Numerous factors, including risks and uncertainties, may affect actual results and may cause results to differ materially from those expressed in forward-looking statements made by the Company or on its behalf. Some of these factors include, but are not limited to, risks related to the Company’s liquidity, the substantial uncertainties inherent in the acceptance of existing and future products, the difficulty of commercializing and protecting new technology, the impact of competitive products and pricing, general business and economic conditions, risks associated with the expansion of our business including the implementation of any businesses we acquire, our indebtedness, the Company’s continued listing on the Nasdaq, and other factors discussed in our public filings, including the risk factors included in the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and the Company’s other periodic reports. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission, the Company is under no obligation to publicly update or revise any forward-looking statement after the date of this release whether as a result of new information, future developments, or otherwise.

All trademarks are the property of their respective owners.

For Investor Information, Contact:

Cody Slach

Investor Relations

Liolios

949.574.3860

For Media Information, Contact:

MacLean Marshall

Sr. Director – Brand & PR/Communications

Turtle Beach Corp.

858.914.5093

maclean.marshall@turtlebeach.com

|

Table 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 18 |

Q1 17 |

|

FY 18 |

FY 17 |

|

|

Guidance |

Actual |

|

Guidance |

Actual |

|

|

|

|

|

|

|

|

Net Revenue |

~$29 |

$14.4M |

|

~$157 |

$149.1M |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

~$(1.5) |

$(6.2)M |

|

~$12 |

$11.6M |

|

|

|

|

|

|

|

|

EPS |

~$(0.12) |

$(0.20) |

|

~$(0.03) |

$(0.07) |

Table 5.

| Q1 18 Guidance |

Q1 17 Actual |

FY 18 Guidance |

FY 17 Actual |

|

|---|---|---|---|---|

| Net Revenue | ~$29 | $14.4M | ~$157 | $149.1M |

| Adjusted EBITDA | ~$(1.5) | $(6.2)M | ~$12 | $11.6M |

| EPS | ~$(0.12) | $(0.20) | ~$(0.03) | $(0.07) |